Securing the future for generations to come

“Thou shalt raise up the foundations of many generations.” – Isaiah 58:12

Seacrest Foundation has many years’ experience in helping to structure planned gifts that fulfill charitable, financial and estate planning goals. We share with you the opportunity to be a part of our planned giving program, the “Legacy of Promise.” Your legacy will ensure that funds are available for Seacrest Village residents to have a warm and loving home for generations to come, or for Seacrest at Home clients to receive needed services in their homes even when resources are limited. There is a great need now, and an even greater need on the horizon. By 2030 the number of people aged 60 and older in San Diego County will increase by 130%.

By including Seacrest Foundation in your estate planning, you join a dedicated community of supporters united in securing the future of Seacrest for generations to come.

You’ll be part of our Legacy of Promise program—a Legacy from you and a Promise from Seacrest Foundation to always help Seacrest meet the needs of the most vulnerable among us. Every planned gift has the power to impact the lives of countless residents and clients. You’ll also receive an invitation to an elegant appreciation dinner and other special events.

Outstanding opportunities to save on taxes, enhance income or protect assets are available. For questions or more information, please contact Robin Israel, Chief Foundation Officer at risrael@seacrestfoundation.org or call (760) 632-0081 so that we may assist you in meeting your goals.

Already included us in your estate plan? Let us know.

Legacy of Promise Members

Our gratitude goes to those whose commitment and dedication ensures the future of Seacrest Village and Seacrest at Home for generations to come. Thank you to these generous visionaries who have named Seacrest Foundation in their legacy plans.

Legacy of Promise Wall of Honor

The Legacy of Promise Wall of Honor shows our appreciation to those who have notified us that they have named Seacrest Foundation in their estate plan through a “planned gift”. Planned Giving includes a bequest to Seacrest Foundation in a will or naming Seacrest Foundation as the beneficiary of assets in a living trust. It provides for those in need while setting a beautiful example for future generations.

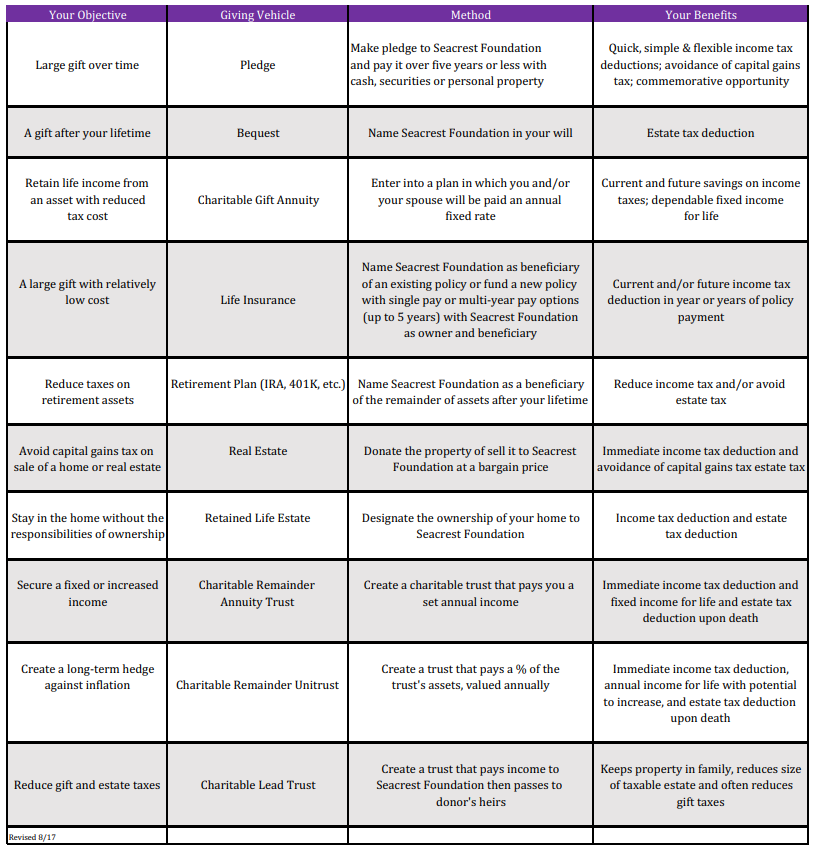

Here are some of the many planned giving options available; however, we would be grateful for an opportunity to consult with you and your financial advisor to decide which may be best for you.

Here are some of the many planned giving options available; however, we would be grateful for an opportunity to consult with you and your financial advisor to decide which may be best for you.

Your Objective

Giving Vehicle

Method

Your Benefits

Large gift over time

Pledge

Make pledge to Seacrest Foundation and pay it over five years or less with cash, securities or personal property

Quick, simple & flexible income tax deductions; avoidance of capital gains tax; commemorative opportunity

A gift after your lifetime

Bequest

Name Seacrest Foundation in your will

Estate tax deduction

Retain life income from an asset with reduced tax cost

Charitable Gift Annuity

Enter into a plan in which you and/or your spouse will be paid an annual fixed rate

Current and future savings on income taxes; dependable fixed income for life

A large gift with relatively low cost

Life Insurance

Name Seacrest Foundation as beneficiary of an existing policy or fund a new policy with single pay or multi-year pay options (up to 5 years) with Seacrest Foundation as owner and beneficiary

Current and/or future income tax deduction in year or years of policy payment

Reduce taxes on retirement assets

Retirement Plan (IRA, 401K, etc)

Name Seacrest Foundation as beneficiary of the remainder of assets after your lifetime

Reduce income tax and/or avoid estate tax

Avoid capital gains tax on sale of a home or real estate

Real Estate

Donate the property or sell it to Seacrest Foundation at a bargain price

Immediate income tax deduction and avoidance of capital gains tax estate tax

Stay in the home without the responsibilities of ownership

Retained Life Estate

Designate the ownership of your home to Seacrest Foundation

Income tax deduction and estate tax deduction

Secure a fixed or increased income

Charitable Remainder Annuity Trust

Create a charitable trust that pays you a set annual income

Immediate income tax deduction and fixed income for life and estate tax deduction upon death

Create a long-term hedge against inflation

Charitable Remainder Unitrust

Create a trust that pays a % of the trust’s assets, valued annually

Immediate income tax deduction, annual income for life with potential to increase, and estate tax deduction upon death

Reduce gift and estate tax

Charitable Lead Trust

Create a trust that pays income to Seacrest Foundation then passes to donor’s heirs

Keeps property in family, reduces size of taxable estate and often reduces gift taxes